Institutional and individual investors in the private sector have been debating for decades the impact of socially responsible investing (SRI)—which is sometimes referred to as environmental, social, and governance (ESG)—on financial returns.

More recently, higher education investors have been discussing the value of SRI for their own communities. Guided by SRI principles, investors consider long-term financial returns alongside positive social or environmental impact. For some organizations, this may mean that they actively divest from and/or screen out companies that produce or sell products that they deem unethical, such as companies that sell alcohol, tobacco, gaming, and fossil fuels. Other SRI/ESG strategies call for investors to select companies and industries that produce products that promote social responsibility and environmental sustainability, such as producers of wind and solar energy.

Do SRI/ESG Strategies Lower Endowment Returns?

In the past, college and university investment committees may have been reluctant to fully adopt SRI/ESG strategies. As fiduciaries, boards are required to seek the maximum return for their endowments with minimal or manageable risk. Using negative screens may interfere with this fiduciary standard.

Indeed, no research has yet addressed the effects of applying SRI strategies to college and university endowments on investment performance. Some studies of other industries suggest that, by excluding certain companies and industries, SRI investors may miss out on higher financial gains, while other studies show that SRI strategies have a positive impact on financial returns. Some research even suggests that SRI has no impact on investment performance. As a result, investors are unsure of whether adopting SRI strategies is worthwhile.

From a college and university board’s perspective, there is inherent tension between maximizing financial returns, on one hand, and "doing what’s right" by investing in companies and industries that are socially responsible, on the other. To help provide some guidance to institutions that may be struggling with these issues, NACUBO investigated the impact of employing SRI on short- and long-term investment performances using data from the 2017 NACUBO-Commonfund Study of Endowments (NCSE).

Signs of SRI Success

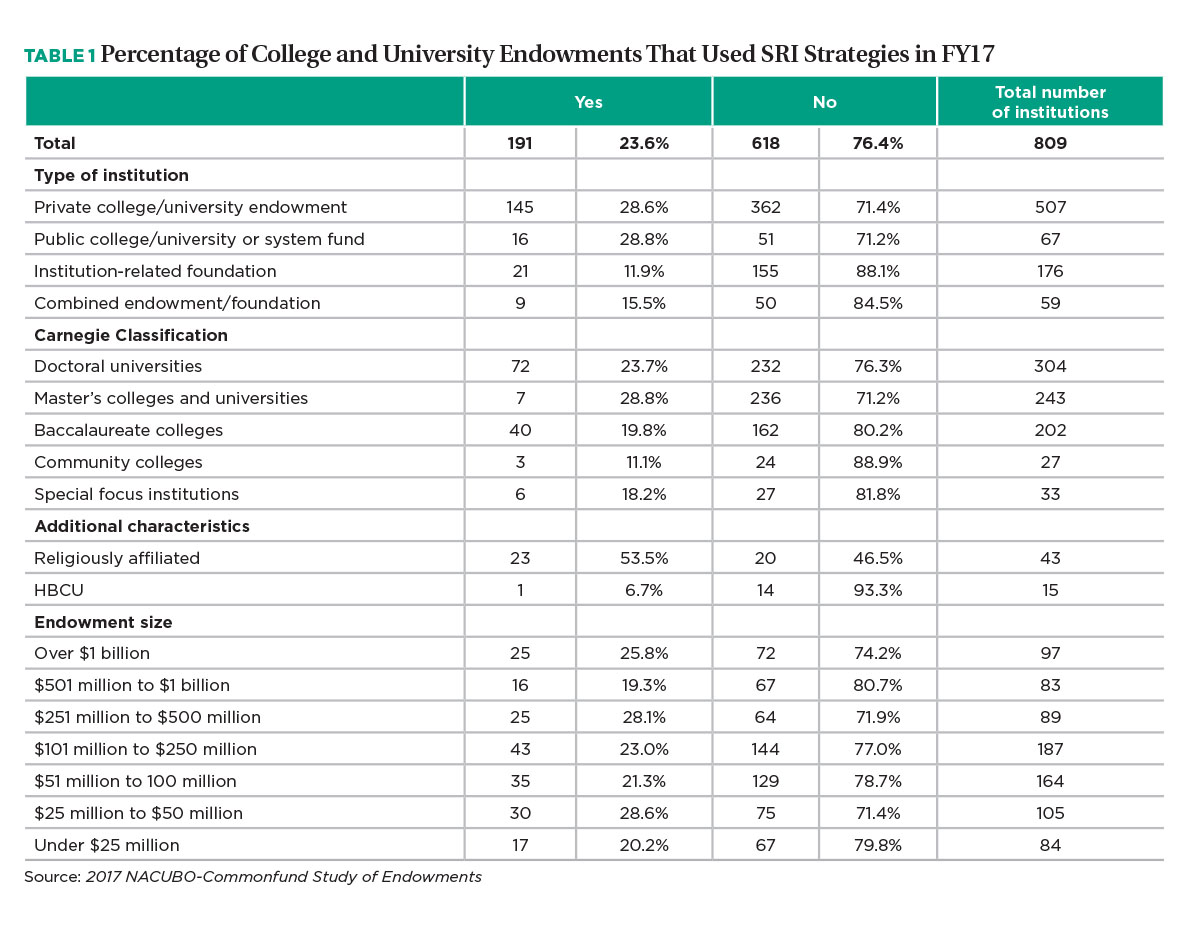

Using the 2017 NCSE data, SRI users were identified based on their response to a survey question asking if their institution uses SRI policies. Institutions that indicated "yes" to the question were counted as SRI users; institutions that indicated "no" or did not respond to the question were counted as non-SRI users. Of the 809 institutions that participated in the study, 191 (23.6 percent) indicated they used SRI strategies, and 618 (76.4 percent) indicated they were non-SRI users (Table 1). Of the institutions using SRI strategies, 145 (75.9 percent) were private, nonprofit institutions—23 of which were religiously affiliated. The largest group of SRI users (43) held FY17 endowments between $101 million and $250 million; and the majority of SRI users (72) were classified as doctorate-granting universities.

By comparing the average one-year and 10-year returns between SRI users and non-SRI users (Table 2), NACUBO has begun developing a picture not just of how many institutions are embracing SRI strategies, but of how these institutions’ investments perform. SRI users realized a 12.1 percent short-term return and a 4.7 percent long-term return. Non-SRI users realized a 12.3 percent short-term return (net of fees) and a 4.5 percent long-term return. The results of the statistical comparisons indicate that, as of FY17, there were no significant differences in the average short- or long-term returns between SRI users and non-SRI users. This result suggests that using SRI strategies did not negatively affect endowment performance during this 10-year period.

After even deeper analysis, NACUBO found that SRI users with endowments in the "over $1 billion" category realized statistically significant higher average one-year returns (13.5 percent) compared to non-SRI users (12.7 percent). This finding is evidence that using SRI can be advantageous for some institutions.

Next, NACUBO compared average asset class investments between SRI and non-SRI users because prior studies have indicated that investment performance is driven, in part, by asset allocation decisions. NACUBO found no significant differences between SRI users and non-SRI users in four out of the five asset class investments in the NCSE: U.S. equities, non-U.S. equities, fixed income, and alternative strategies (Table 2). Within the alternative strategies asset class, however, there was a statistically significant difference between SRI and non-SRI users whose endowments were in the "$51 million to $100 million" category. Of this group, the SRI users invested 17.5 percent of their resources in alternatives, on average, compared to 23.3 percent invested by non-SRI users. In the remaining asset class, "average cash and other," NACUBO found two significant results. First, on average, SRI users invested 6.3 percent of their resources and non-SRI users invested 4.3 percent. Second, SRI users in the "under $25 million" endowment size category invested statistically significantly more in this asset class than non-SRI users, 8.7 percent versus 4.1 percent.

Lastly, NACUBO created a statistical model to test the overall impact of using SRI on short-term and long-term investment performance across institutions in the 2017 study. In the model, NACUBO included data on asset allocations and endowment market value per full-time-equivalent (FTE) student to isolate the effect of SRI, if any. The results of the model are consistent with NACUBO’s analysis, which illustrates that, on average, the impact of SRI on short- and long-term investment performance is insignificant.

Therefore, on average, the short- and long-term investment performance between SRI users and non-SRI users is not statistically different. More simply, this means that, once all known factors are adjusted for, schools that used SRI strategies in their endowment portfolios appear to have performed approximately the same as those that did not. Use of SRI did not adversely affect short- or long-term gains in endowment investments.

Implications for the Future

What does this mean for college and university endowments? First, it is important to note that there are several factors that may impact investment performance that cannot be adjusted for, such as manager selection and more exact portfolio construction. NACUBO thus cautions that schools more fully study their own context if they advocate for the full adoption of SRI policies. Future investment performance cannot be determined based solely on a replication of the asset allocation strategies or techniques of these SRI policy adopters (i.e., institutions that used such strategies as of FY17).

NACUBO’s findings do offer this significant insight: using SRI strategies, on average, does not appear to negatively affect investment returns, meaning it is possible to realize positive social and environmental returns without sacrificing financial returns. For institutions considering the adoption of SRI strategies, further exploration is worthwhile to discern if SRI strategies align with your institution’s mission and strategy moving forward.

STEFFON M. GRAY is assistant director, research and policy analysis, NACUBO.